Distribution Planning

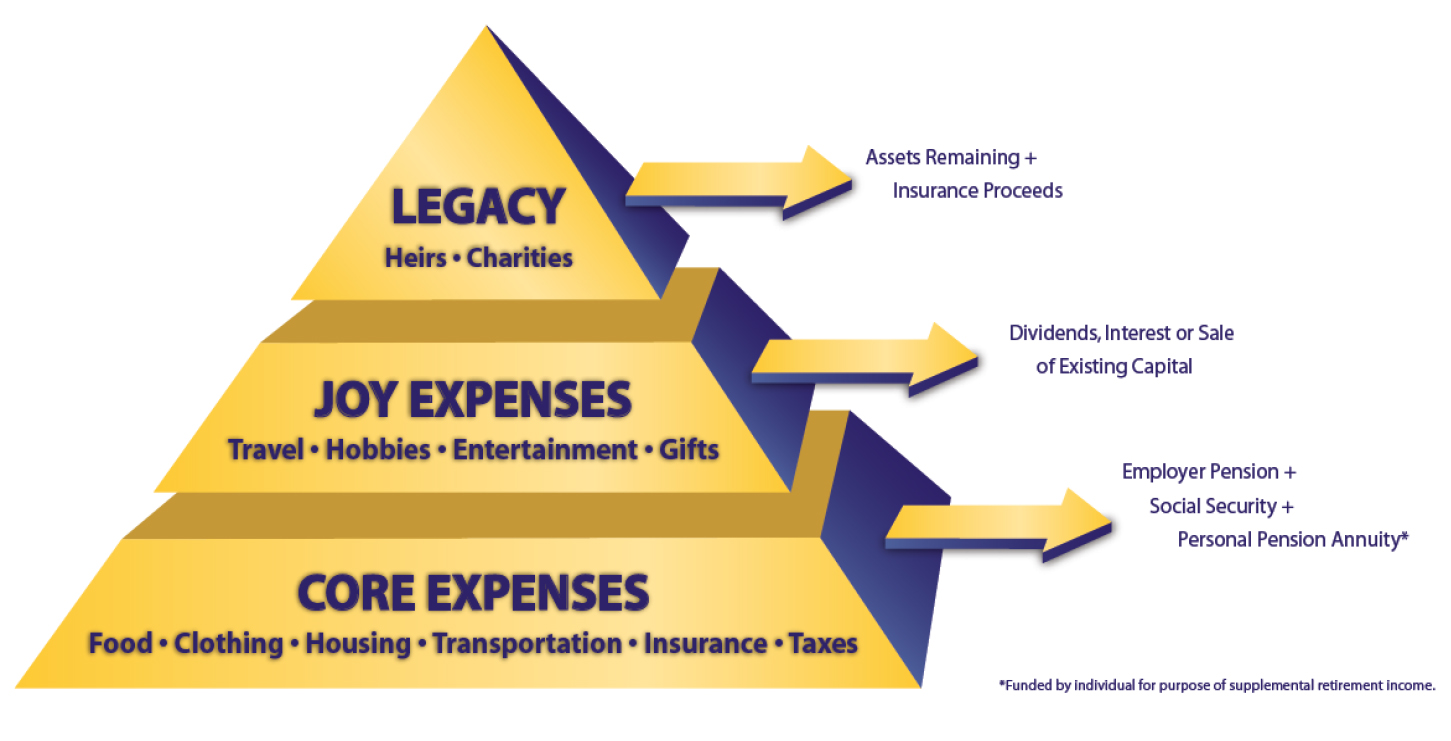

To retire with confidence, we believe that having a well-orchestrated retirement income plan is essential. By working with our clients to understand income needs, we can carefully craft a distribution plan that considers stable income sources (pensions, annuities, Social Security, etc.). Each client’s expenses can vary dramatically, therefore it is important to develop an intentional and customized approach as to when and how income is derived.

By exploring a client’s vision for their assets and legacy desires we can help focus on what matters most. Establishing and monitoring distributions in retirement can be what defines a successful outcome versus one that falls short.